Does Insurance Cover Therapy? Understanding Your Mental Health Benefits in DC

Wondering “does insurance cover therapy?” You’re not alone. Here’s what you need to know about mental health insurance coverage, including options you might not have considered.

If you’re asking whether does insurance cover therapy, the short answer is yes—but how it works depends on your specific health insurance plan and the type of provider you see. Under federal law, most health insurance plans are required to cover mental health services, including therapy. However, the details of your insurance coverage—what you’ll pay, which therapists you can see, and how to access your benefits—vary significantly depending on whether you choose an in-network or out-of-network provider.

Many people assume they’re limited to in-network therapists, but if you have a PPO plan (preferred provider organization), which is common among DC federal employees and professionals, you likely have out-of-network benefits that reimburse 50-80% of therapy costs. This opens access to doctoral-level psychologists and specialized care that may not be available in-network. Understanding both options helps you make informed decisions about your mental health care.

Knowing how your insurance covers therapy in DC helps you access necessary mental health care without unexpected costs.

What Federal Law Requires for Mental Health Coverage

Two major federal laws govern mental health insurance coverage in the United States, and they apply to most health insurance plans:

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 requires health insurance plans to cover mental health and substance use disorder services equally to medical and surgical care. This means your insurance company cannot impose stricter limits, higher copays, or more restrictive requirements on mental health treatment than they do for physical health conditions. Research shows this law extended protections to 60 million Americans.

The Affordable Care Act (ACA) of 2010 made mental health and substance use disorder services one of 10 essential health benefits that individual and small group health insurance plans must cover. This requirement applies to health plans purchased through the health insurance marketplace and significantly expanded access to mental health services.

Together, these laws ensure that most insurance plans cover therapy services, though your specific out-of-pocket costs will vary based on your plan type and provider choice.

What Mental Health Parity Means for Your Coverage

Mental health parity means your health insurance plan must treat mental health coverage the same as coverage for physical health conditions. Your insurance company cannot require higher copays for therapy than for medical appointments, impose stricter session limits on mental health treatment, or require prior authorization for therapy if they don’t require it for medical care. If your health plan covers 20 physical therapy sessions without prior approval, they must offer comparable coverage for mental health therapy sessions. This protection ensures that insurance plans don’t discriminate against mental health services through financial requirements or treatment limitations.

We regularly see clients who’ve been told by their insurance company that therapy “isn’t covered” when what they really mean is “we don’t have in-network providers in your area.” When this happens, many people don’t realize they can request a single-case agreement or simply use their out-of-network benefits to access the care they need.

These federal protections provide the foundation for your mental health coverage, but the specific details depend on your insurance plan type.

How Different Insurance Plans Cover Therapy

Private Insurance (Employer-Sponsored and Marketplace Plans)

Most private health insurance plans—whether through your employer or purchased on the health insurance marketplace—must cover psychotherapy as part of their mental health services benefits. While coverage typically includes cost-sharing like copayments, coinsurance, or deductibles, the specific amounts depend on your plan design.

In Washington, DC, where federal government employment is common, many professionals have access to comprehensive PPO plans with both in-network and out-of-network mental health coverage. These health insurance plans often provide more flexibility in choosing providers than HMO or other restrictive plan types.

Medicaid

Medicaid typically covers a broad range of behavioral health services, including therapy. DC expanded Medicaid coverage under the Affordable Care Act, making more residents eligible. However, many therapists don’t accept Medicaid due to lower reimbursement rates, which can make finding available providers challenging.

Medicare

Medicare covers psychotherapy services for eligible beneficiaries. However, therapist acceptance rates vary, and you may face challenges finding providers who accept Medicare assignment.

In our practice, we frequently work with clients who have comprehensive PPO plans through federal employment. These insurance plans typically offer out-of-network benefits that allow access to doctoral-level care while still receiving meaningful insurance reimbursement—often 50-80% of session costs.

Understanding your plan type is the first step—next, you’ll need to decide between in-network and out-of-network providers.

Understanding In-Network vs. Out-of-Network Coverage

One of the most important distinctions in mental health insurance coverage is whether your therapist is in-network or out-of-network with your insurance plan.

In-Network Providers

In-network therapists have contracted with your insurance company to provide services at pre-negotiated rates. When you see an in-network provider:

- You typically pay lower copayments or coinsurance

- The therapist bills your insurance company directly

- Your out-of-pocket costs are more predictable

- In-network providers cost less overall

Out-of-Network Providers

Out-of-network therapists don’t have contracts with your insurance company. However, if your health insurance plan includes out-of-network benefits (as many PPO plans do):

- You can still receive partial reimbursement for therapy costs

- You typically pay the therapist’s full fee upfront

- Out-of-network costs are higher, but you may access specialized expertise

Why Many Therapists Choose to Stay Out-of-Network

It’s important to understand that over 80% don’t accept insurance in some areas, particularly public insurance like Medicaid or Medicare. Many doctoral-level psychologists and specialized therapists choose to remain out-of-network to:

- Maintain treatment flexibility without insurance company restrictions

- Offer longer or more frequent sessions when clinically indicated

- Avoid the administrative burden of insurance panel participation

- Provide trauma-informed therapy approaches that insurance companies may not adequately reimburse

This means limiting yourself to in-network options may significantly restrict your access to specialized care or doctoral-level providers.

If you have out-of-network benefits, understanding how the reimbursement process works can help you make an informed decision about accessing specialized care.

How Out-of-Network Benefits Work (And How We Make It Easy)

If you have out-of-network mental health benefits, here’s how the process typically works—and how Therapy Group of DC simplifies it for you.

Verifying Your Out-of-Network Benefits

Before starting therapy, call the member services number on your insurance card and ask:

- Do I have out-of-network benefits for mental health services?

- What is my out-of-network deductible, and how much have I met?

- What percentage does my insurance plan reimburse for out-of-network therapy?

- Is there a session limit or annual maximum?

- Do I need pre-authorization?

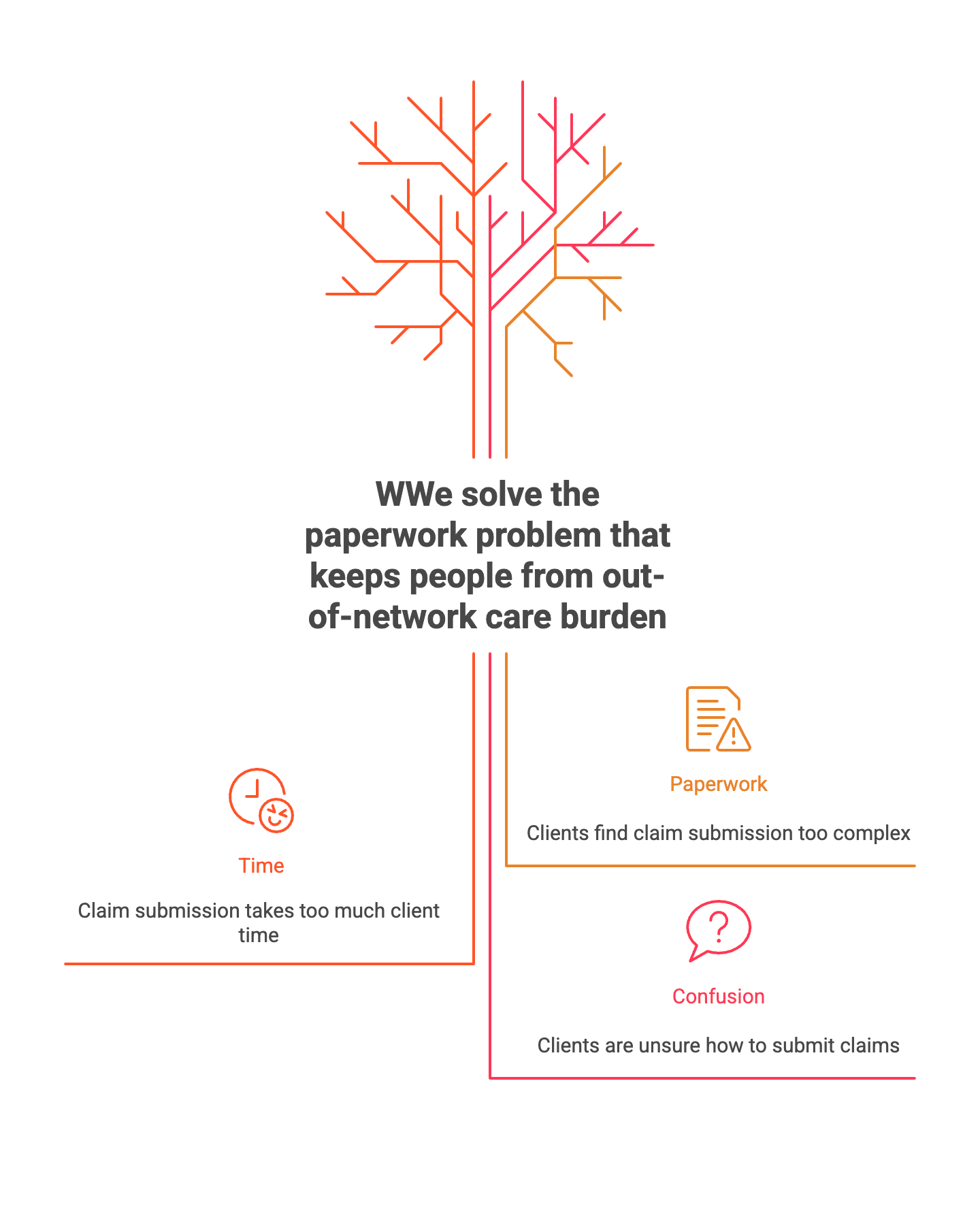

How We Handle Claims Filing for You

You pay your therapist’s full session fee at the time of service. As of late 2025, according to Fair Health Consumer data, the usual and customary out-of-network cost for a 45-minute therapy session (CPT 90834) in Washington, DC is $259.

Here’s where Therapy Group of DC differs from most out-of-network practices:

Most out-of-network therapists simply provide you with a superbill (a detailed receipt) that you must submit yourself to your insurance company. This means you’re responsible for:

- Downloading and completing claim forms

- Submitting documentation through your insurance portal or by mail

- Following up on denied or delayed claims

- Tracking reimbursements

At Therapy Group of DC, we electronically file your out-of-network claims for you. This means:

- We handle all the paperwork and electronic filing

- You don’t need to submit anything yourself

- Your insurance company sends reimbursement checks directly to you

This courtesy service helps eliminate the administrative burden that often deters people from seeking out-of-network care, even when they have excellent reimbursement benefits.

We created our electronic claims filing service specifically because we saw too many people avoiding out-of-network care due to paperwork concerns, even when their insurance benefits were excellent. By handling the administrative work, we make it easier for clients to access the specialized care they need.

Understanding Your Reimbursement

Most insurance companies reimburse out-of-network therapy at 50-80% reimbursement of the allowed amount after you’ve met your deductible. Processing typically takes 2-4 weeks.

Example Calculation (Scenario 1):

- Session fee: $259

- Insurance allowed amount: $200

- Your coinsurance: 30%

- You pay therapist: $259

- Insurance reimburses you: $140 (70% of $200)

- Your actual cost per session: $119

Example Calculation (Scenario 2 – Higher Reimbursement):

- Session fee: $259

- Insurance allowed amount: $220

- Your coinsurance: 20%

- You pay therapist: $259

- Insurance reimburses you: $176 (80% of $220)

- Your actual cost per session: $83

For many clients with good PPO plans, this means accessing doctoral-level care for roughly $80-$120 per session after reimbursement—comparable to many in-network copays, but with access to specialized expertise and flexible treatment approaches.

Beyond understanding reimbursement, knowing your out-of-pocket costs upfront helps you budget for therapy.

What You’ll Pay for Therapy

Your out-of-pocket costs for therapy depend on several factors related to your specific health insurance plan:

Copayments: A fixed dollar amount you pay per therapy session, typically $20-$50 for in-network care. Some insurance plans use copayments while others use coinsurance.

Coinsurance: A percentage of the therapy session cost you’re responsible for paying. For example, 20% coinsurance means you pay 20% of the session fee and your insurance covers 80%.

Deductibles: The amount you must pay out-of-pocket before your insurance coverage kicks in. Many health insurance plans have separate deductibles for in-network and out-of-network services, with out-of-network deductibles typically being higher.

Out-of-Pocket Maximum: The maximum amount you’ll pay in a calendar year. Once you reach this limit, your health insurance plan covers 100% of covered services.

It’s worth noting that the cost gap has widened between in-network and out-of-network therapy over time, making it even more important to understand your specific benefits before starting treatment. To learn more about typical therapy costs in DC, we’ve created a detailed guide.

Once you understand potential costs, the next step is verifying your specific coverage details.

Steps to Verify Your Insurance Coverage for Therapy

Taking these steps before your first therapy appointment can prevent billing surprises:

1. Call Your Insurance Company

Use the member services phone number on the back of your insurance card. Have your member ID ready and ask:

- Is outpatient mental health therapy covered under my plan?

- What are my copayment or coinsurance amounts?

- Do I have both in-network and out-of-network mental health benefits?

- How many therapy sessions does my insurance plan cover per year?

- Do I need a referral from my primary care physician?

- Have I met my deductible for this year?

2. Get Information in Writing

Ask your insurance company to email you a summary of your mental health benefits, or take detailed notes including the representative’s name and date of your call.

3. Contact the Therapy Practice

Before your first session, contact the therapist’s office to:

- Confirm whether they’re in-network or out-of-network with your insurance plan

- Ask about session fees and payment policies

- Understand how claims are filed (will they file for you, or do you file?)

- Inquire about any additional billing services they offer

4. Understand Your Financial Responsibility

Make sure you clearly understand what you’ll pay per session and whether that amount counts toward your deductible and out-of-pocket maximum.

Even with insurance coverage, you may have additional questions about how mental health benefits work in practice.

Affordable Options If Insurance Isn’t Enough

If your insurance doesn’t cover therapy, if you’re uninsured, or if you’re looking for more affordable options, several alternatives exist:

Capital Therapy Project

Therapy Group of DC operates Capital Therapy Project, which offers lower-fee therapy services to make mental health care more accessible. This program provides quality care at reduced rates for clients who need more affordable options while still receiving treatment from trained therapists.

Sliding Scale Fees

Some therapists offer reduced rates based on your income and ability to pay. Ask potential therapists if they offer sliding scale fees.

Employee Assistance Programs (EAPs)

Many employers provide EAP benefits that include a limited number of free counseling sessions (typically 3-8 sessions) for employees and their families.

Community Mental Health Centers

These centers often provide low-cost or free therapy services based on financial need.

Payment Plans

Some therapy practices offer payment plans that allow you to spread the cost of therapy over time.

Training Clinics

Graduate programs in psychology and social work often operate training clinics where supervised graduate students provide therapy at reduced rates.

Whether you choose insurance-covered care, out-of-network services with reimbursement, or one of our affordable alternatives, taking the first step is what matters most.

Getting Started with Therapy in Washington, DC

Understanding your insurance coverage is an important step, but don’t let concerns about costs prevent you from seeking help. Mental health treatment is an investment in your wellbeing, and many options exist to make it accessible.

Whether you choose in-network or out-of-network care, the most important factor is finding a therapist with the right expertise for your specific needs. In DC’s high-pressure environment, access to doctoral-level psychologists with specialized training can make a significant difference in treatment outcomes. We offer different therapeutic approaches tailored to individual needs, including couples counseling in Washington, DC.

When you’re ready to start therapy, begin by verifying your out-of-network mental health benefits with a quick call to your insurance company. Have your insurance card handy and ask specifically about your out-of-network deductible, coinsurance rate, and whether you need prior authorization for outpatient mental health care. Then contact Therapy Group of DC to discuss how our electronic claims filing process works for out-of-network benefits, or learn about our Capital Therapy Project options.

Frequently Asked Questions About Insurance Coverage for Therapy

Does insurance cover online therapy?

Most plans cover telehealth equally to in-person therapy sessions, as long as the therapist is licensed to practice in your state. This became more widely accepted during the COVID-19 pandemic and has continued for most insurance plans.

Do I need a mental health diagnosis for insurance to cover therapy?

Most insurance companies require a mental health diagnosis for therapy coverage, as they must determine that treatment is medically necessary. Your therapist will provide a diagnosis code when filing claims or superbills.

How many therapy sessions does insurance cover?

This varies by health insurance plan. Some insurance plans have session limits (for example, 20 sessions per year), while others have no specific limit. Under mental health parity laws, your insurance plan cannot place stricter limits on therapy than on medical or surgical care.

What if my insurance denies coverage?

If you believe your insurance company is unfairly denying mental health coverage, you can appeal denied claims. Your therapist’s office or insurance company can explain the appeals process. Mental health parity laws provide protections if insurers are not treating mental health coverage equally to medical care.

If traditional insurance coverage isn’t available or sufficient, several alternative options can make therapy more accessible.

Medical Disclaimer:

This article is for informational purposes only and does not constitute medical or insurance advice. Insurance coverage varies significantly by plan and provider. For specific questions about your coverage, contact your insurance company directly. If you’re experiencing a mental health emergency, call 911 or go to your nearest emergency room.